Money: the ongoing evolution

In this article, I'm going to solve all the monetary problems of the modern world.

Oh, you think that's funny? I'm being serious.

Alright, then. I'm going to try and solve them. Money is a concept, a product and a system that's been undergoing constant refinement since the dawn of civilisation; and, as the world's current financial woes are testament to, it's clear that we still haven't gotten it quite right. That's because getting financial systems right is hard. If it were easy, we'd have done it already.

I'm going to start with some background, discussing the basics such as: what is money, and where does it come from? What is credit? What's the history of money, and of credit? How do central banks operate? How do modern currencies attain value? And then I'm going to move on to the fun stuff: what can we do to improve the system? What's the next step in the ongoing evolution of money and finance?

Disclaimer: I am not an economist or a banker; I have no formal education in economics or finance; and I have no work experience in these fields. I'm just a regular bloke, who's been thinking about these big issues, and reading up on a lot of material, and who would like to share his understandings and his conclusions with the world.

Ancient history

Money has been around for a while. When I talk about money, I'm talking cash. The stuff that leaves a smell on your fingers. The stuff that jingles in your pockets. Cold hard cash.

The earliest known example of money dates back to the 7th century BC, when the Lydians minted coins using a natural gold-based alloy called electrum. They were a crude affair – with each coin being of a slightly different shape – but they evolved to become reasonably consistent in their weight in precious metal; and many of them also bore official seals or insignias.

Source: Ancient coins.

From Lydia, the phenomenom of minted precious-metal coinage spread: first to her immediate neighbours – the Greek and Persian empires – and then to the rest of the civilised world. By the time the Romans rose to significance, around the 3rd century BC, coinage had become the norm as a medium of exchange; and the Romans established this further with their standard-issue coins, most notably the Denarius, which were easily verifiable and reliable in their precious metal content.

Source: London Evening Standard. Quote: Life of Brian haggling scene.

Money, therefore, is nothing new. This should come as no surprise to you.

What may surprise you, however, is that credit existed before the arrival of money. How can that be? I hear you say. Isn't credit – the business of lending, and of recording and repaying a debt – a newer and more advanced concept than money? No! Quite the reverse. In fact, credit is the most fundamental concept of all in the realm of commerce; and historical evidence shows that it was actually established and refined, well before cold hard cash hit the scene. I'll elaborate further when I get on to definitions (next section). For now, just bear with me.

One of the earliest known historical examples of credit – in the form of what essentially amount to "IOU" documents – is from Ancient Babylonia:

… in ancient Babylonia … common commercial documents … are what are called "contract tablets" or "shuhati tablets" … These tablets, the oldest of which were in use from 2000 to 3000 years B. C. are of baked or sun-dried clay … The greater number are simple records of transactions in terms of "she," which is understood by archaeologists to be grain of some sort.

…

From the frequency with which these tablets have been met with, from the durability of the material of which they are made, from the care with which they were preserved in temples which are known to have served as banks, and more especially from the nature of the inscriptions, it may be judged that they correspond to the medieval tally and to the modern bill of exchange; that is to say, that they are simple acknowledgments of indebtedness given to the seller by the buyer in payment of a purchase, and that they were the common instrument of commerce.

But perhaps a still more convincing proof of their nature is to be found in the fact that some of the tablets are entirely enclosed in tight-fitting clay envelopes or "cases," as they are called, which have to be broken off before the tablet itself can be inspected … The particular significance of these "case tablets" lies in the fact that they were obviously not intended as mere records to remain in the possession of the debtor, but that they were signed and sealed documents, and were issued to the creditor, and no doubt passed from hand to hand like tallies and bills of exchange. When the debt was paid, we are told that it was customary to break the tablet.

We know, of course, hardly anything about the commerce of those far-off days, but what we do know is, that great commerce was carried on and that the transfer of credit from hand to hand and from place to place was as well known to the Babylonians as it is to us. We have the accounts of great merchant or banking firms taking part in state finance and state tax collection, just as the great Genoese and Florentine bankers did in the middle ages, and as our banks do to-day.

Source: What is Money?

Original source: The Banking Law Journal, May 1913, By A. Mitchell Innes.

As the source above mentions (and as it describes in further detail elsewhere), another historical example of credit – as opposed to money – is from medieval Europe, where the split tally stick was commonplace. In particular, in medieval England, the tally stick became a key financial instrument used for taxation and for managing the Crown accounts:

A tally stick is "a long wooden stick used as a receipt." When money was paid in, a stick was inscribed and marked with combinations of notches representing the sum of money paid, the size of the cut corresponding to the size of the sum. The stick was then split in two, the larger piece (the stock) going to the payer, and the smaller piece being kept by the payee. When the books were audited the official would have been able to produce the stick with exactly matched the tip, and the stick was then surrendered to the Exchequer.

Tallies provide the earliest form of bookkeeping. They were used in England by the Royal Exchequer from about the twelfth century onward. Since the notches for the sums were cut right through both pieces and since no stick splits in an even manner, the method was virtually foolproof against forgery. They were used by the sheriff to collect taxes and to remit them to the king. They were also used by private individuals and institutions, to register debts, record fines, collect rents, enter payments for services rendered, and so forth. By the thirteenth century, the financial market for tallies was sufficiently sophisticated that they could be bought, sold, or discounted.

Source: Tally sticks.

Source: The National Archives.

It should be noted that unlike the contract tablets of Babylonia (and the similar relics of other civilisations of that era), the medieval tally stick existed alongside an established metal-coin-based money system. The ancient tablets recorded payments made, or debts owed, in raw goods (e.g. "on this Tuesday, Bishbosh the Great received eight goats from Hammalduck", or "as of this Thursday, Kimtar owes five kwetzelgrams of silver and nine bushels of wheat to Washtawoo"). These societies may have, in reality, recorded most transactions in terms of precious metals (indeed, it's believed that the silver shekel emerged as the standard unit in ancient Mesopotamia); but these units had non-standard shapes and were unsigned, whereas classical coinage was uniform in shape, and possessed insignias.

In medieval England, the common currency was sterling silver, which consisted primarily of silver penny coins (but there were also silver shilling coins, and gold pound coins). The medieval tally sticks recorded payments made, or debts owed, in monetary value (e.g. "on this Monday, Lord Snottyham received one shilling and eight pence from James Yoohooson", or "as of this Wednesday, Lance Alot owes sixpence to Sir Robin").

Definitions

Enough history for now. Let's stop for a minute, and get some basic definitions clear.

First and foremost, the most basic question of all, but one that surprisingly few people have ever actually stopped to think about: what is money?

There are numerous answers:

Money is a medium of exchange.

Source: The Privateer - What is money?

Money itself … is useless until the moment we use it to purchase or invest in something. Although money feels as if it has an objective value, its worth is almost completely subjective.

Source: Forbes - Money! What is it good for?

As with other things, necessity is, indeed, the mother of invention. People needed a formula of stating the standard value of trade goods.

Thus, money was born.

Source: The Daily Bluster - Where did money come from, anyway?

The seller and the depositor alike receive a credit, the one on the official bank and the other direct on the government treasury, The effect is precisely the same in both cases. The coin, the paper certificates, the bank-notes and the credit on the books of the bank, are all indentical in their nature, whatever the difference of form or of intrinsic value. A priceless gem or a worthless bit of paper may equally be a token of debt, so long as the receiver knows what it stands for and the giver acknowledges his obligation to take it back in payment of a debt due.

Money, then, is credit and nothing but credit. A's money is B's debt to him, and when B pays his debt, A's money disappears. This is the whole theory of money.

Source: What is Money?

Original source: The Banking Law Journal, May 1913, By A. Mitchell Innes.

Image source: DuckTales…Woo-ooo!

I think the first definition is the easiest to understand. Money is a medium of exchange: it has no value in and of itself; but it allows us to more easily exchange between ourselves, things that do have value.

I think the last definition, however, is the most honest. Money is credit: or, to be more correct, money is a type of credit; a credit that is expressed in a uniform, easily quantifiable / divisible / exchangeable unit of measure (as opposed to a credit that's expressed in goats, or in bushels of wheat).

(Note: the idea of money as credit, and of credit as debt, comes from the credit theory of money, which was primarily formulated by Innes (quoted above). This is just one theory of money. It's not the definitive theory of money. However, I tend to agree with the theory's tenets, and various parts of the rest of this article are founded on the theory. Also, it should not be confused with The Theory of Money and Credit, a book from the Austrian School of economics, which asserts that the only true money is commodity money, and which is thus pretty well the opposite extreme from the credit theory of money.)

Which brings us to the next defintion: what is credit?

In the article giving the definition of "money as credit", it's also mentioned that "credit" and "debt" are effectively the same thing; just that the two words represent the two sides of a single relationship / transaction. So, then, perhaps it would make more sense to define what is debt:

Middle English dette: from Old French, based on Latin debitum 'something owed', past participle of debere 'owe'.

Source: Oxford dictionaries: debt.

A debt is something that one owes; it is one's obligation to give something of value, in return for something that one received.

Conversely, a credit is the fact of one being owed something; it is a promise that one has from another person / entity, that one will be given something of value in the future.

So, then, if we put the two definitions together, we can conclude that: money is nothing more than a promise, from the person / entity who issued the money, that they will give something of value in the future, to the current holder of the money.

Perhaps the simplest to understand example of this, in the modern world, is the gift card typically offered by retailers. A gift card has no value itself: it's nothing more than a promise by the retailer, that they will give the holder of the card a shirt, or a DVD, or a kettle. When the card holder comes into the shop six months later, and says: "I'd like to buy that shirt with this gift card", what he/she really means is: "I have here a written promise from you folks, that you will give me a shirt; I am now collecting what was promised". Once the shirt has been received, the gift card is suddenly worthless, as the documented promise has been fulfilled; this is why, when the retailer reclaims the gift card, they usually just dispose of it.

However, there is one important thing to note: the only value of the gift card, is that it's a promise of being exchangeable for something else; and as long as that promise remains true, the gift card has value. In the case of a gift card, the promise ceases to be true the moment that you receive the shirt; the card itself returns to its original issuer (the retailer), and the story ends there.

Money works the same way, only with one important difference: it's a promise from the government, of being exchangeable for something else; and when you exchange that money with a retailer, in return for a shirt, the promise remains true; so the money still has value. As long as the money continues to be exchanged between regular citizens, the money is not returned to its original issuer, and so the story continues.

So, as with a gift card: the moment that money is returned to its original issuer (the government), that money is suddenly worthless, as the documented promise has been fulfilled. What do we usually return money to the government for? Taxes. What did the government originally promise us, by issuing money to us? That it would take care of us (it doesn't buy us flowers or send us Christmas cards very often; it demonstrates its caring for us mainly with other things, such as education and healthcare). What happens when we pay taxes? The government takes care of us for another year (it's supposed to, anyway). Therefore, the promise ceases to be true; and, believe it or not, the moment that the government reclaims the money in taxes, that money ceases to exist.

The main thing that a government promises, when it issues money, is that it will take care of its citizens; but that's not the only promise of money. Prior to quite recent times, money was based on gold: people used to give their gold to the government, and in return they received money; so, money was a promise that the government would give you back your gold, if you ever wanted to swap again.

In the modern economic system, the governments of the world no longer promise to give you gold (although most governments still have quite a lot of gold, in secret buildings with a lot of fancy locks and many armed guards). Instead, by issuing money these days, a government just promises that its money is worth as much as its economy is worth; this is why governments and citizens the world over are awfully concerned about having a "strong economy". However, what exactly defines "the economy" is rather complicated, and it only gets trickier with every passing year.

So, a very useful side effect of money – as opposed to gift cards – is that as long as the promise of money remains true (i.e. as long as the government keeps taking care of its people, and as long as the economy remains strong), regular people can use whatever money they have left-over (i.e. whatever money doesn't return to the government, at which point it ceases to exist), as a useful medium of exchange in regular day-to-day commerce. But remember: when you exchange your money for a kettle at the shop, this is what happens: at the end of the day, you have a kettle (something of value); and the shop has a promise from the government that it is entitled to something (presumably, something of value).

Recent history

Back to our history class. This time, more recent history. The modern monetary system could be said to have begun in 1694, when the Bank of England was founded. The impetus for establishing it should be familiar to all 21st-century readers: the government of England was deeply in debt; and the Bank was founded in order to acquire a loan of £1.2 million for the Crown. Over the subsequent centuries, it evolved to become the world's first central bank. Also, of great note, this marked the first time in history that a bank (rather than the king) was given the authority to mint new money.

Image source: Scene by scene Mary Poppins.

During the 18th and 19th centuries, and also well into the 20th century, the modern monetary system was based on the gold standard. Under this system, countries tied the value of their currency to gold, by guaranteeing to buy and sell gold at a fixed price. As a consequence, the value of a country's currency depended directly on the amount of gold reserves in its possession. Also, consequently, money at that time represented a promise, by the money's issuer, to give an exact quantity of gold to its current holder. This could be seen as a hangover from ancient and medieval times, when money was literally worth the weight of gold (or, more commonly, silver) of which the coins were composed (as discussed above).

During that same time period, the foundation currency – and by far the dominant currency – of the world monetary system was the British Pound. As the world's strongest economy, the world's largest empire (and hence the world's largest trading bloc), and the world's most industrialised nation, all other currencies were valued relative to the Pound. The Pound became the reserve currency of choice for nations worldwide, and most international transactions were denominated with it.

In the aftermath of World War II, the Allies emerged victorious; but the Pound Sterling met its defeat at long last, at the hands of a new world currency: the US Dollar. Because the War had taken place in Europe (and Asia), the financial cost to the European Allied powers was crippling; North America, on the other hand, hadn't witnessed a single enemy soldier set foot on its soil, and so it was that, with the introduction of the Bretton Woods system in 1944, the Greenback rapidly and ruthlessly conquered the world.

Image source: The Guardian: Reel history.

Under the Bretton Woods system, the gold standard remained in place: the only real difference, was that gold was now spelled with a capital S with a line through it ($), instead of being spelled with a capital L with a line through it (£). The US Dollar replaced the Pound as the dominant world reserve currency and international transaction currency.

The gold standard finally came to an end when, in 1971, President Nixon ended the direct convertibility of US Dollars to gold. Since then, the USD has continued to reign supreme over all other currencies (although it's been increasingly facing competition). However, under the current system, there is no longer a "other currencies -> USD -> gold" pecking order. Theoretically, all currencies are now created equal; and gold is now just one more commodity on the world market, rather than "the shiny stuff that gives money value".

Since the end of Bretton Woods, the world's major currencies exist in a floating exchange rate regime. This means that the only way to measure a given currency's value, is by determining what quantity of another given currency it's worth. Instead of being tied to the value of a real-life object (such as gold), the value of a currency just "floats" up and down, depending on the fluctuations in that country's economy, and depending on the fluctuations in peoples' relative perceptions of its value.

What we have now

The modern monetary system is a complex beast, but at its heart it consists of three players.

Image source: HydraVM.

First, there are the governments of the world. In most countries, there's a department that "represents" the government as a whole, within the monetary system: this is usually called the "Treasury"; it may also be called the Ministry of Finance, among other names. Contrary to what you might think, Treasury does not bring new money into existence (even though Treasury usually governs a country's mint, and thus Treasury is the manufacturer of new physical money).

As discussed in definitions (above), in a "pure" system, money comes into existence when the government issues it (as a promise), and money ceases to exist when the government takes it back (in return for fulfilling a promise). However, in the modern system, the job of bringing new money into existence has been delegated; therefore, money does not cease to exist, the moment that it returns to the government (i.e. the "un-creation" of money has also been delegated).

This delegation allows the government itself to function like any other individual or entity within the system. That is, the government has an "account balance", it receives monetary income (via taxation), it spends money (via its budget program), and it can either be "in the green" or "in the red" (with a strong tendency towards the latter). Thus, the government itself doesn't have to worry too much about the really complicated parts of the modern monetary system; and instead, it can just get on with the job of running the country. The government can also borrow money, to supplement what it receives from taxation; and it can lend money, in addition to its regular spending.

Second, there are these things called "central banks" (also known as "reserve banks", among other names). In a nutshell: the central bank is the entity to which all that stuff I just mentioned gets delegated. The central bank brings new money into existence – officially on behalf of the government; but since the government is usually highly restricted from interfering with the central bank's operation, this is a half-truth at best. It creates new money in a variety of ways. One way – which in practice is usually responsible for only a small fraction of overall money creation, but which I believe is worth focusing on nonetheless – is by buying government (i.e. Treasury) bonds.

Just what is a bond? (Seems we're not yet done with definitions, after all.) A bond is a type of debt (or a type of credit, depending on your perspective). A lends money to B, and in return, B gives A bonds. The bonds are a promise that the debt will be repaid, according to various terms (time period, interest payable, etc). So, bonds themselves have no value: they're just a promise that the holder of the bonds will receive something of value, at some point in the future. In the case of government bonds, the bonds are a promise that the government will provide something of value to their current holder.

But, hang on… isn't that also what money is? A promise that the government will provide something of value to the current holder of the money? So, let me get this straight: the Treasury writes a document (bonds) saying "The government (on behalf of the Treasury) promises to give the holder of this document something of value", and gives it to the central bank; and in return, the central bank writes a document (money) also saying "The government (on behalf of the central bank) promises to give the holder of this document something of value", and gives it to the Treasury; and at the end of the day, the government has more money? Or, in other words (no less tangled): the government lends itself money, and money is also itself a government loan? Ummm… WTF?!

Image source: Lol Zone.

Third, there are the commercial banks. The main role of these (private) companies is to safeguard the deposits of, and provide loans to, the general public. The main (original) source of commercial banks' money, is from the deposits of their customers. However, thanks to the practice of fractional reserve banking that's prevalent in the modern monetary system, commercial banks are also responsible for about 95% of the money creation that occurs today; almost all of this private-bank-created money is interest (and principal) from loans. So, yes: money is created out of thin air; and, yes, the majority of money is not created by the government (either on behalf of Treasury or the central bank), but by commercial banks. No surprise, then, that about 97% of the world's money exists only electronically in commercial bank accounts (with physical cash making up the other 3%).

This presents another interesting conundrum: all money supposedly comes from the government, and is supposedly a promise from the government that they will provide something of value; but in today's reality, most of our money wasn't created by the government, it was created by commercial banks! So, then: if I have $100 in my bank account, does that money represent a promise from the government, or a promise from the commercial banks? And if it's a promise from the commercial banks… what are they promising? Beats me. As far as I know, commercial banks don't promise to take care of society; they don't promise to exchange money for gold; I suppose the only possibility is that, much as the government promises that money is worth as much as the nation's economy is worth, commercial banks promise that money is worth as much as they are worth.

And what are commercial banks worth? A lot of money (and not much else), I suppose… which starts taking us round in circles.

I should also mention here, that the central banks' favourite and most oft-used tool in controlling the creation of money, is not the buying or selling of bonds; it's something else that we hear about all the time in the news: the raising or lowering of official interest rates. Now that I've discussed how 95% of money creation occurs via the creation of loans and interest within commercial banks, it should be clear why interest rates are given such importance by government and by the media. The central bank only sets the "official" interest rate, which is merely a guide for commercial banks to follow; but in practice, commercial banks adjust their actual interest rates to closely match the official one. So, in case you had any lingering doubts: the central banks and the commercial banks are, of course, all "in on it" together.

Oh yeah, I almost forgot… and then there are regular people. Just trying to eke out a living, doing whatever's necessary to bring home the dough, and in general trying to enjoy life, despite the best efforts of the multi-headed beast mentioned above. But they're not so important; in fact, they hardly count at all.

In summary: today's system is very big and complex, but for the most part it works. Somehow. Sort of.

Broken promises

In case you haven't worked it out yet: money is debt; debt is credit; and credit is promises.

Bankers, like politicians, are big on promises. In fact, bankers are full of promises (by definition, since they're full of money). And, also like politicians, bankers are good at breaking promises.

Or, to phrase it more accurately: bankers are good at convincing you to make promises (i.e. to take out a loan); and they're good at promising you that you'll have no problem in not breaking your promises (i.e. in paying back the loan); and they're good at promising you that making and not breaking your promises will be really worthwhile for you (i.e. you'll get a return on your loan); and (their favourite part) they're exceedingly good at holding you to your promises, and at taking you to the dry cleaners in the event that you are truly unable to fulfil your promises.

Since money is debt, and since money makes the world go round, the fact that the world is full of debt really shouldn't make anyone raise an eyebrow. What this really means, is that the world is full of promises. This isn't necessarily a bad thing, assuming that the promises being made are fair. In general, however, they are grossly unfair.

Let's take a typical business loan as an example. Let's say that Norbert wants to open a biscuit shop. He doesn't have enough money to get started, so he asks the bank for a loan. The bank lends Norbert a sum of money, with a total repayment over 10 years of double the value of the sum being lent (as is the norm). Norbert uses the money to buy a cash register, biscuit tins, and biscuits, and to rent a suitable shop venue.

There are two possibilities for Norbert. First, he generates sufficient business selling biscuits to pay off the loan (which includes rewarding the bank with interest payments that are worth as much as it cost him to start the business), and he goes on selling biscuits happily ever after. Second, he fails to bring in enough revenue from the biscuit enterprise to pay off the loan, in which case the bank seizes all of his business-related assets, and he's left with nothing. If he's lucky, Norbert can go back to his old job as a biscuit-shop sales assistant.

What did Norbert input, in order to get the business started? All his time and energy, for a sustained period. What was the real cost of this input? Very high: Norbert's time and energy is a tangible asset, which he could have invested elsewhere had he chosen (e.g. in building a giant Lego elephant). And what is the risk to Norbert? Very high: if business goes bad (and the biscuit market can get volatile at times), he loses everything.

What did the bank input, in order to get the business started? Money. What was the real cost of this input? Nothing: the bank pulled the money out of thin air in order to lend it to Norbert; apart from some administrative procedures, the bank effectively spent nothing. And what is the risk to the bank? None: if business goes well, they get back double the money that they lent Norbert (which was fabricated the moment that the loan was approved anyway); if business goes bad, they seize all Norbert's business-related assets (biscuit tins and biscuits are tangible assets), and as for the money… well, they just fabricated it in the first place anyway, didn't they?

Broke(n) nations

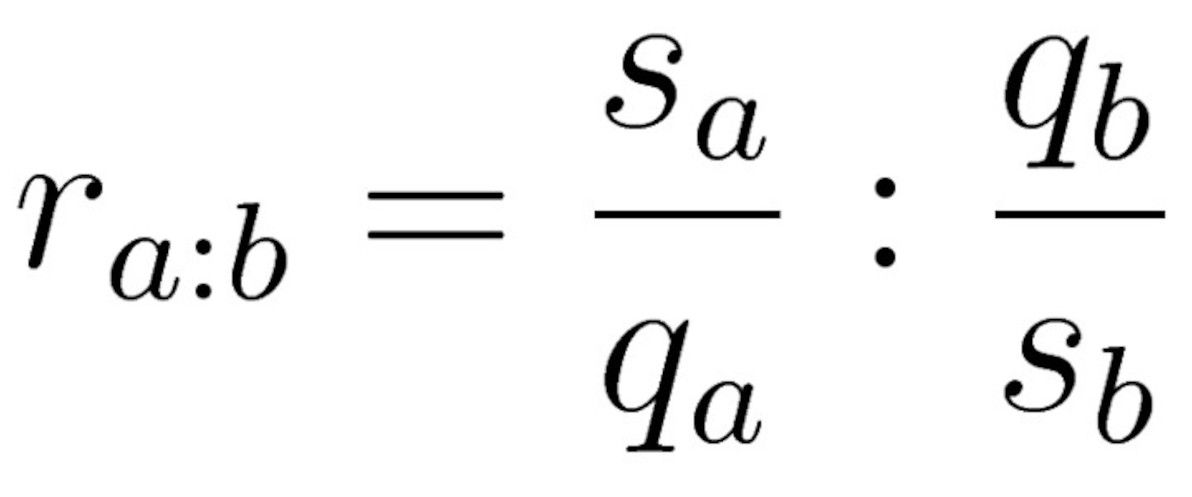

One theme that I haven't touched on specifically so far, is the foreign currency exchange system. However, I've already explained that money is worth as much as a nation's economy is worth; so, logically, the stronger a nation's economy is, the more that nation's money is worth. This is the essence of foreign currency exchange mechanics. Here's a formula that I just invented, but that I believe is reasonably accurate, for determining the exchange rate r between two given currencies a and b:

That's: ra:b = (sa ÷ qa) : (qb ÷ sb)

Where sx is the strength of the given economy, and qx is the quantity of the given currency in existence.

So, for example, say we want to determine the exchange rate of US Dollars to Molvanîan Strubls. Let's assume that the US economy is worth "1,000,000" (which is good), and that there are 1,000,000 US Dollars (a) in existence; and let's assume that the Molvanîan economy is worth "100" (which is not so good), and that there are 1,000,000,000 Molvanîan Strubls (b) in existence. Substituting values into the formula, we get:

ra:b = (1,000,000 ÷ 1,000,000 USD) : (1,000,000,000 Strubls ÷ 100)

ra:b = 1 USD : 10,000,000 Strubls

This, in my opinion, should be sufficient demonstration of why the currencies of strong economies have value, and why people the world over like getting their hands dirty with them; and why the currencies of weak economies lack value, and why their only practical use is for cleaning certain dirty orifices of one's body.

Image source: praag.org.

Now, getting back to the topic of lending money. Above, I discussed how banks lend money to individuals. As it turns out, banks also lend money to foreign countries. Either commercial banks, central banks, or an international bank (such as the IMF), doesn't matter in this context. And, either foreign individuals, foreign companies, or foreign governments, doesn't matter either in this context. The point is: there are folks whose local currency isn't accepted worldwide (if it's even accepted locally), and who need to purchase goods and services from the world market; and so, these folks ask for a loan from banks elsewhere, who are able to lend them money in a strong currency.

The example scenario that I described above (Norbert), applies equally here. Only this time, Norbert is a group of people from a developing country (let's call them The Morbert Group), and the bank is a corporation from a developed country. As in Norbert's case, The Morbert Group input a lot of time and effort to start a new business; and the bank input money that it pulled out of thin air. And, as in Norbert's case, The Morbert Group has a high risk of losing everything, and at the very least is required to pay an exorbitant amount of interest on its loan; whereas the bank has virtually no risk of losing anything, as it's a case of "the house always wins".

So, the injustice of grossly unfair and oft-broken promises between banks and society doesn't just occur within a single national economy, it occurs on a worldwide scale within today's globalised economy. Yes, the bank is the house; and yes (aside from a few hiccups), the house just keeps winning and winning. This is how, in the modern monetary system, a nation's rich people keep getting richer while its poor people keep getting poorer; and it's how the world's rich countries keep getting richer, while the poor countries keep getting poorer.

Serious problems

Don't ask "how did it come to this?" I've just spent a large number of words explaining how it's come to this (see everything above). Face the facts: it has come to this. The modern monetary system has some very serious problems. Here's my summary of what I think those problems are:

- Currency inequality promotes poverty. In my opinion, this is the worst and the most disgraceful of all our problems. A currency is only worth as much as its nation's economy is worth. This is wrong. It means that the people who are issued that currency, participate in the global economy with a giant handicap. It's not their fault that they were born in a country with a weaker economy. Instead, a currency should be worth as much as its nation's people are worth. And all people in all countries are "worth" the same amount (or, at least, they should be).

- Governments manipulate currency for their own purposes. All (widely-accepted) currency in the world today is issued by governments, and is controlled by the world's central banks. While many argue that the tools used to manipulate the value of currency – such as adjusting interest rates, and trading in bonds – are "essential" for "stabilising" the economy, it's clear that very often, governments and/or banks abuse these tools in the pursuit of more questionable goals. Governments and central banks (particularly those in "strong" countries, such as the US) shouldn't have the level of control that they do over the global financial system.

- Almost all new money is created by commercial banks. The creation of new money should not be entrusted to a handful of privileged companies around the world. These companies continue to simply amass ever-greater quantities of money, further promoting poverty and injustice. Money creation should be more fairly distributed between all individuals and between all nations.

- It's no longer clear what gives money its value. In the olden days, money was "backed" by gold. Under the current system, money is supposedly backed by the value of the issuing country's economy. However, the majority of new money today is created by commercial banks, so it's unclear if that's really true or not. Perhaps a new way definition of what "backs" money is needed?

Now, at long last – after much discussion of promises made and promises broken – it's time to fulfil the promise that I made at the start of this article. Time to solve all the monetary problems of the modern world!

Possible solutions

One alternative to the modern monetary system, and its fiat money roots (i.e. money "backed by nothing"), is a return to the gold standard. This is actually one of the more popular alternatives, with many arguing that it worked for thousands of years, and that it's only for the past 40-odd years (i.e. since the Nixon Shock in 1971) that we've been experimenting with the current (broken) system.

This is a very conservative argument. The advocates of "bringing back the gold standard" are heavily criticised by the wider community of economists, for failing to address the issues that caused the gold standard to be dropped in the first place. In particular, the critics point out that the modern world economy has been growing much faster than the world's supply of gold has been growing, and that there literally isn't enough physical gold available, for it to serve as the foundation of the modern monetary system.

Personally, I take the critics' side: the gold standard worked up until modern times; but gold is a finite resource, and it has certain physical characteristics that limit its practical use (e.g. it's quite heavy, it's not easily divisible into sufficiently small parts, etc). Gold will always be a valuable commodity – and, as the current economic crisis shows, people will always turn to gold when they lose confidence in even the most stable of regular currencies – but its days as the foundation of currency were terminated for a reason, and so I don't think it's altogether bad that we relegate the gold standard to the annals of history.

How about getting rid of money altogether? For virtually as long as money has existed, it's been often labelled "the root of all evil". The most obvious solution to the world's money problems, therefore, is one that's commonly proposed: "let's just eliminate money." This has been the cry of hippies, of communists, of utopianists, of futurists, and of many others.

Image source: Etsy.

Unfortunately, the most prominent example so far in world history of (effectively) eliminating money – 20th century communism – was also an economic disaster. In the Soviet Union, although there was money, the price of all basic goods and services was fixed, and everything was centrally distributed; so money was, in effect, little more than a rationing token. Hence the famous Russian joke: "We pretend to work, They pretend to pay us".

Utopian science fiction is also rife with examples of a future without money. The best-known and best-developed example is Star Trek (an example with which I'm also personally well-acquainted). In the Star Trek universe, where virtually all of humanity's basic needs (i.e. food, clothing, shelter, education, medicine) are provided for in limitless supply by modern technology, "the economics of the future are somewhat different". As Captain Picard says in First Contact: "The acquisition of wealth is no longer the driving force in our lives. We work to better ourselves and the rest of humanity." This is a great idea in principle; but Star Trek also fails to address the practical issues of such a system, any better than contemporary communist theory does.

Image source: Moar Powah.

While I'm strongly of the opinion that our current monetary system needs reform, I don't think that abolishing the use of money is: (a) practical (assuming that we want trade and market systems to continue existing in some form); or (b) going to actually address the issues of inequality, corruption, and systemic instability that we'd all like to see improved. Abolishing money altogether is not practical, because we do require some medium of exchange in order for the civilised world (which has always been built on trade) to function; and it's not going to address the core issues, because money is not the root of all evil, money is just a tool which can be used for either good or bad purposes (the same as a hammer can be used to build a house or to knock someone on the head – the hammer itself is "neutral"). The problem is not money; the problem is greed.

For a very different sci-fi take on the future of money, check out the movie In Time (2011). In this dystopian work, there is a new worldwide currency: time. Every human being is born with a "biological watch", that shows on his/her forearm how much time he/she has left to live. People can earn time, trade with time, steal time, donate time, and store time (in time banks). If you "time out" (i.e. run out of time), you die instantly.

Image source: MyMovie Critic.

The monetary system presented by In Time is interesting, because it's actually very stable (i.e. the value of "time" is very clear, and time as a currency is quite resilient to inflation / deflation, speculation, etc), and it's a currency that's "backed" by a real commodity (i.e. time left alive; commodities don't get much more vital). However, the system also has gross potential for inequality and corruption – and indeed, in the movie, it's clearly demonstrated that everyone could live indefinitely if the banks just kept rewarding infinte quantities of time; but instead. time is meagerly rationed out by the rich and powerful elite (who can create more time out of thin air whenever they want, much as today's elite do with money), in order to enforce a status quo upon the impoverished masses.

One of the most concerted efforts that has been made in recent times, to disrupt (and potentially revolutionise) the contemporary monetary system, is the much-publicised Bitcoin project. Bitcoin is a virtual currency, which isn't issued or backed by any national government (or by any official organisation at all, for that matter), but which is engineered to mimic many of the key characteristics of gold. In particular, there's a finite supply of Bitcoins; and new Bitcoins can only be created by "mining" them.

Bitcoin makes no secret of the fact that it aims to become a new global world currency, and to bring about the demise of traditional government-issued currency. As I've already stated here, I'm in favour of replacing the current world currencies; and I applaud Bitcoin's pioneering endeavours to do this. Bitcoin sports the key property that I think any contender to the "brave new world of money" would need: it's not generated by central banks, nor by any other traditional contemporary authority. However, there are a number of serious flaws in the Bitcoin model, which (in my opinion) mean that Bitcoin cannot and (more importantly) should not ever achieve this.

Most importantly, Bitcoin fails to adequately address the issue of "money creation should be fairly distributed between all". In the Bitcoin model, money creation is in the hands of those who succeed in "mining" new Bitcoins; and "mining" Bitcoins consists of solving computationally expensive cryptographic calculations, using the most powerful computer hardware possible. So, much as Bitcoin shares many of gold's advantages, it also shares many of its flaws. Much as gold mining unfairly favours those who discover the gold-hills first, and thereafter favours those with the biggest drills and the most grunt; so too does Bitcoin unfairly favour those who knew about Bitcoin from the start, and thereafter favour those with the beefiest and best-engineered hardware.

Image source: adelaidenow.

Bitcoin also fails to address the issue of "what gives money its value". In fact, "what gives Bitcoin its value" is even less clear than "what gives contemporary fiat money its value". What "backs" Bitcoin? Not gold. Not any banks. Not any governments or economies. Supposedly, Bitcoin "is" the virtual equivalent of gold; but then again (as others have stated), I'll believe that the day I'm shown how to convert digital Bitcoins into physical metal chunks that are measured in Troy ounces. It's also not clear if Bitcoin is a commodity or a currency (or both, or neither); and if it's a commodity, it's not completely clear how it would succeed as the foundation of the world monetary system, where gold failed.

Plus, assuming that Bitcoin is the virtual equivalent of gold, the fact that it's virtual (i.e. technology-dependent for its very existence) is itself a massive disadvantage, compared to a physical commodity. What happens if the Internet goes down? What happens if there's a power failure? What happens if the world runs out of computer hardware? Bye-bye Bitcoin. What happens to gold (or physical fiat money) in any of these cases? Nothing.

Additionally, there's also significant doubt and uncertainty over the credibility of Bitcoin, meaning that it fails to address the issue of "manipulation of currency [by its issuers] for their own purposes". In particular, many have accused Bitcoin of being a giant scam in the form of a Ponzi scheme, which will ultimately crash and burn, but not before the system's founders and earliest adopters "jump ship" and take a fortune with them. The fact that Bitcoin's inventor goes by the fake name "Satoshi Nakamoto", and has disappeared from the Bitcoin community (and kept his true identity a complete mystery) ever since, hardly enhances Bitcoin's reputation.

This article is not about Bitcoin; I'm just presenting Bitcoin here, as one of the recently-proposed solutions to the problems of the world monetary system. I've heavily criticised Bitcoin here, to the point that I've claimed it's not suitable as the foundation of a new world monetary system. However, let me emphasise that I also really admire the positive characteristics of Bitcoin, which are numerous; and I hope that one day, a newer incarnation is born that borrows these positive characteristics of Bitcoin, while also addressing Bitcoin's flaws (and we owe our thanks to Bitcoin's creator(s), for leaving us an open-source system that's unencumbered by copyright, patents, etc). Indeed, I'd say that just as non-virtual money has undergone numerous evolutions throughout history (not necessarily with each new evolution being "better" than its predecessors); so too will virtual currency undergo numerous evolutions (hopefully with each new evolution being "better"). Bitcoin is only the beginning.

My humble proposal

The solution that I'd like to propose, is a hybrid of various properties of what's been explored already. However, the fundamental tenet of my solution, is something that I haven't discussed at all so far, and it is as follows:

Every human being in the world automatically receives an "allowance", all the time, all their life. This "allowance" could be thought of as a "global minimum wage"; although everyone receives it regardless of, and separate to, their income from work and investments. The allowance could be received once a second, or once a day, or once a month – doesn't really matter; I guess that's more a practical question of the trade-off in: "the more frequent the allowance, the more overhead involved; the less frequent the allowance, the less accurate the system is."

Ideally, the introduction of this allowance would be accompanied by the introduction of a new currency; and this allowance would be the only permitted manner in which new units of the currency are brought into existence. That is, new units of the currency cannot be generated ad lib by central banks or by any other organisation (and it would be literally impossible to circumvent this, a la Bitcoin, thus making the currency a commodity rather than a fiat entity). However, a new currency is not the essential idea – the global allowance per person is the core – and it could be done with one or more existing currencies, although this would obviously have disadvantages.

The new currency for distributing the allowance would also ideally exist primarily in digital form. It would be great if, unlike Bitcoin and its contemporaries, the currency could also exist in a physical commodity form, with an easy way of transforming the currency between digital and physical form, and vice versa. This would require technology that doesn't currently exist – or, at the least, some very clever engineering with the use of current technology – and is more "wishful thinking" at this stage. Additionally, the currency could also exist as an "account balance" genetically / biologically stored within each person, much like in the movie In Time; except that you don't die if you run out of money (you just ain't got no money). However, all of this is non-essential bells and whistles, supplementing my core proposal.

There are a number of other implementation details, that I don't think particularly need to all be addressed at the conceptual level, but that would be significant at the practical level. For example: should the currency be completely "tamper-proof", or should there be some new international body that could modify various parameters (e.g. change the amount of the allowance)? And should the allowance be exactly the same for everyone, or should it vary according to age, physical location, etc? Personally, I'd opt for a completely "tamper-proof" currency, and for a completely standard allowance; but other opinions may differ.

Taxation would operate in much the same way as it does now (i.e. a government's primary source of revenue, would be taxing the income of its citizens); however, the wealth difference between countries would reduce significantly, because at a minimum, every country would receive revenue purely based on its population.

A global allowance (issued in the form of a global currency), doesn't necessarily mean a global government (although the two would certainly function much better together). It also doesn't necessarily mean the end of national currencies; although national currencies would probably, in the long run, struggle to compete for value / relevance with a successful global currency, and would die out.

If there's a global currency, and a global allowance for everyone on the planet, but still individual national governments (some of which would be much poorer and less developed than others), then taxation would still be at the discretion of each nation. Quite possibly, all nations would end up taxing 100% of the allowance that their citizens receive (and corrupt third-world nations would definitely do this); in which case it would not actually be an allowance for individuals, but just a way of enforcing more economic equality between countries based on population.

However, this doesn't necessarily make the whole scheme pointless. If a developing country receives the same revenue from its population's global allowance, as a developed country does (due to similar population sizes), then: the developing country would be able to compete more fairly in world trade; it would be able to attract more investment; and it wouldn't have to ask for loans and to be indebted to wealthier countries.

So, with such a system, the generated currency wouldn't be backed by anything (no more than Bitcoin is backed by anything) – but it wouldn't be fiat, either; it would be a commodity. In effect, people would be the underlying commodity. This is a radical new approach to money. It would also have potential for corruption (e.g. it could lead to countries kidnapping / enslaving each others' populations, in order to steal the commodity value of another country). However, appropriate practical safeguards in the measuring of a country's population, and in the actual distribution of new units of the currency, should be able to prevent this.

It's not absolutely necessary that a new global currency is created, in order to implement the "money for all countries based on population" idea: all countries could just be authorised to mint / receive a quantity of an existing major currency (e.g. USD or EUR) proportional to its population. However, this would be more prone to corruption, and would lack the other advantages of a new global currency (i.e. not backed by any one country, not produced by any central bank).

It has been suggested that a population-based currency is doomed to failure:

So here is were [sic] you need to specify. What happens at round two?

If you do nothing things would go back to how they are now. The rich countries would have the biggest supply of this universal currency (and the most buying power) and the poor countries would loose [sic] their buying power after this one explosive buying spree.And things would go back to exactly as they are now- no disaster-but no improvemen [sic] to anything.

But if youre [sic] proposing to maintain this condition of equal per capita money supply for every nation then you have to rectify the tendency of the universal currency to flow back to the high productivity countries. Buck the trend of the market somehow.

Dont [sic] know how you would do it. And if you were able to do it I would think that it would cause severe havoc to the world economy.It would amount to very severe global income redistribution.

The poor countries could use this lopsided monetary system to their long term advantage by abstaining from buying consumer goods and going full throttle into buying capital goods from industrialized world to industrialize their own countries. In the long term that would be good for them and for the rich countries as well.So it could be viewed as a radical form of foreign aid. But its [sic] a little too radical.

Source: Wrong Planet.

Alright: so once you get to "round two" in this system, the developed countries once again have more money than the developing countries. However, that isn't any worse than what we've got at the moment.

And, alright: so this system would effectively amount to little more than a radical form of foreign aid. But why "too radical"? In my opinion, the way the world currently manages foreign aid is not working (as evidenced by the fact that the gap between the world's richest and poorest nations is increasing, not decreasing). The world needs a radical form of foreign aid. So, in my opinion: if the net result of a global currency whose creation and distribution is tied to national populations, is a radical form of foreign aid; then, surely what would be a good system!

Conclusion

So, there you have it. A monster of an article examining the entire history of money, exploring the many problems with the current world monetary system, and proposing a humble solution, which isn't necessarily a good solution (in fact, it isn't even necessarily better than, or as good as, the other possible solutions that are presented here), but which at least takes a shot at tackling this age-old dilemna. Money: can't live with it; can't live without it.

Money has already been a work-in-progress for about 5,000 years; and I'm glad to see that at this very moment, efforts are being actively made to continue refining that work-in-progress. I think that, regardless of what theory of money one subscribes to (e.g. money as credit, money as a commodity, etc), one could describe money as being the "grease" in the global trade machine, and actual goods and services as being the "cogs and gears" in the machine. That is: money isn't the machine itself, and the machine itself is more important than money; but then again, the machine doesn't function without money; and the better the money works, the better the machine works.

So, considering that trade is the foundation of our civilised existence… let's keep refining money. There's still plenty of room for improvement.